Why MoT Certificates are Vital in Credit Hire Cases

In this blog, classic car enthusiast and Civil Litigation Barrister Peter Quegan explores how MoT certificates can be vital in Credit Hire claims by steering us through his recent remarkable case: Carr v AA Underwriting Insurance Company Limited.

Carr v AA Underwriting Insurance Company Limited was heard on December 22nd, 2022, at Manchester County Court. Despite the relatively low value of the claim, both parties were granted leave to rely upon expert engineering advice.

They were disputing the causation of damage to a Citroen Berlingo van as well as the subsequent Credit Hire.

The Claimant’s expert was David Grant of Legal and Technical Assessors Limited. Mr Grant completed a desktop report on the Citroen Berlingo, which found that Mr Carr’s vehicle was unroadworthy, due to ‘sharp edges’.

Meanwhile, the Defendant’s expert was Paul Mellor of Associated Independent Assessors Limited. Mr Mellor found the vehicle to be roadworthy after completing a physical examination of the vehicle before it had been taken for any repairs.

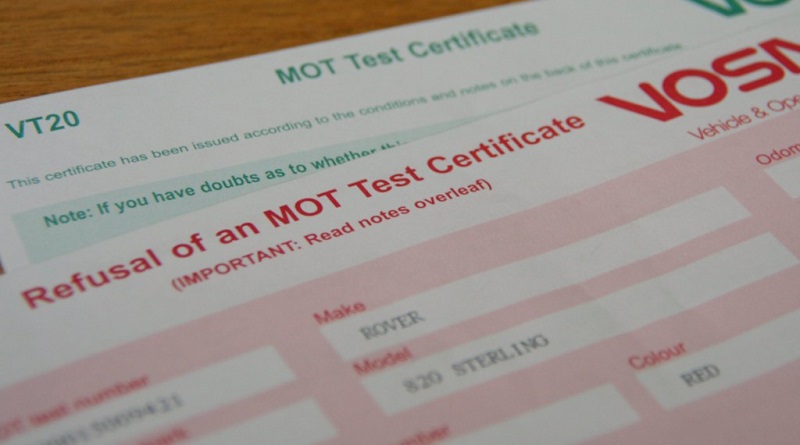

Additionally, four days after the accident, the Citroen Berlingo in question passed an MoT test with no mandatory or advisory fixes to carry out!

In Part 35 questions, Mr Grant had been asked whether the physical examination of the vehicle should trump his desktop report based on photographs of the van. Mr Grant declined to change his opinion and suggested that the MoT Tester’s view on the alleged ‘sharp edges’ was dependent upon their opinion and experience.

Then, during cross-examination, Mr Carr was questioned about his trust in the MoT Tester. Mr Carr confirmed that having used the Tester on previous occasions, he was confident the Tester would not have allowed him to drive a dangerous vehicle, and ultimately, the van was never repaired. He also conceded that he continued to drive the vehicle for almost a year post-accident and that he had only ceased to drive it two weeks before the trial, because the gearbox had failed.

Mr Grant’s initial determination that the vehicle was unroadworthy had been used to justify the hire of a replacement vehicle, which ran for 19 days. Strangely, Mr Carr had taken Mr Grant’s concerns to heart and had got a second MoT test for the vehicle. However, this was another 19 days after the hire had ended and, crucially, after he had put 432 extra miles on the Citroen Berlingo.

Whilst Deputy District Judge McCormick ruled in favour of Mr Carr on the causation of the damage, he disallowed any claim for Credit Hire. Mr Carr had used Mr Grant’s findings to justify the replacement vehicle hire, but because he had chosen to ignore the expert’s advice after the hire period came to an end, by using his ‘unroadworthy’ vehicle again, he had negated the need for the hire.

What we learn from the case of Carr v AA Underwriting Insurance Company Limited, is the vital importance of exploiting open-source information. In this case, the MoT certificates undermined the credibility of the Claimant’s report and exposed Mr Grant’s unwillingness to defer to the opinions of the MoT Tester and Mr Mellor.

It is perhaps strange that the Judge chose not to rely upon two flawless MoT certificates, or Mr Mellor’s report, given that he had examined the vehicle, whilst Mr Grant had simply viewed photographs of it.

MoT certificates disclose mileage. This is often useful in negating arguments that there is a need for a replacement vehicle, especially when annual mileage is low, or when the certificate shows that there has been significant mileage undertaken after an accident, as in this case.

In Credit Hire cases, Claimants’ Engineer’s reports are often flimsy, especially if they are desktop reports where the expert has not had the chance to physically inspect the vehicle. Such reports often deem vehicles unroadworthy due to ‘sharp edges’, the ‘smell of fuel’, or sometimes without a reason.

Fortunately, in this case, it was the causation dispute that justified the cost of the Defendant’s report. However, it would probably pay dividends if more Claimants’ reports were subject to expert scrutiny.

Peter Quegan has regularly appeared in court in civil disputes such as road traffic accidents and Credit Hire dating as far back as Dimond v Lovell in 2000 when as a Solicitor many of his Motorcycle Courier clients used credit bikes to get back to work.

Since coming to the Bar, he has regularly represented both Claimants and Defendants in Credit Hire disputes, often of significant value, although almost always now in car and taxi cases.

If you have a Civil Litigation case you need Peter Quegan for, call our Civil Clerks Michael Jones and Alessandro Saportia-Clark on 0161 832 4036, email [email protected], [email protected], or fill out our contact form.